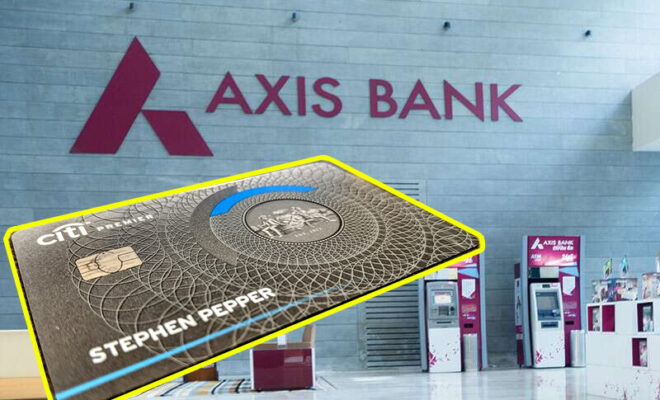

Satisfied With Citi Card Business & Citi’s Portfolio: Axis Bank

As per Axis Bank, Citibank’s credit card business is of high quality, and usage patterns and spending were adequate. They’re satisfied with Citi’s portfolio.

Sanjeev Moghe, president & head of cards & payments at the private insurer, stated on Wednesday that Axis Bank is confident in its ability to deliver value for the sum it is paying for Citi’s retail business in India.

In response to a query regarding recent media claims claiming the activation of a “clawback” mechanism in the agreement and a possible decrease in the total amount which Citi would collect due to declining client bases and revenues, Moghe stated that the reports were “false.”

Also Read: Top 10 Best Payment Apps for Money Transfer and Digital Wallets 2022

According to Moghe, “We are quite confident in what we have investigated and the pricing that we have offered. I assume those parameters don’t vary.”

In March 2022, Axis announced that it will pay ₹ 12,235 crore to acquire Citi’s retail division. In 18 to 24 months, the merger will go “smoothly,” according to Moghe, who represented the bank.

Moghe was addressing at an event promoting a partnership between Axis Bank with Eazydiner.

Through this partnership, Axis Bank’s 3 crore cardholders will receive up to 40% off discounts on select credit cards as well as significant birthday discounts at more than 10,000 eateries.

The fact that Citi’s portfolio had been experiencing down-growth for some time was not anything Moghe seemed bothered about.

“Their (Citi’s) spending is a significant indication of what is happening, and since total spending is increasing, those measures appear to be satisfactory.

It’s okay that the portfolio size is shrinking, Sanjeev Moghe said, noting that Axis Bank had not yet contacted Citi’s clients.

The non-performing asset (NPA) ratios for Axis Bank and Citi, according to Moghe, were in balance. “Typically, you run your card business with an NPA of 4% to 5%. It is currently significantly lower. We don’t make that number public. I am aware that our number is fully under control, and this figure is for the industry, he said.

Also Read: Citigroup Retail Exit Not To Be Fire Sale In India

Moghe added that Axis would not be impacted by the Reserve Bank of India’s recent decision to prohibit non-bank prepaid payment mechanisms from being acquired through credit lines.

According to him, Axis Bank would keep offering “buy now, pay later” options through partnerships with retailers.

When discussing the partnership with Eazydiner, Moghe predicted that the overall contribution from dining on card expenses would stay between 3 and 5%.

However, the executive noted that these alliances enhance clients’ use of Axis Bank cards.