RBI Keeps The Repo Rate Unchanged At 4% For The Tenth Consecutive Time

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) on Thursday kept the repo rate unchanged at 4 per cent for the tenth consecutive time because of an elevated level of inflation.

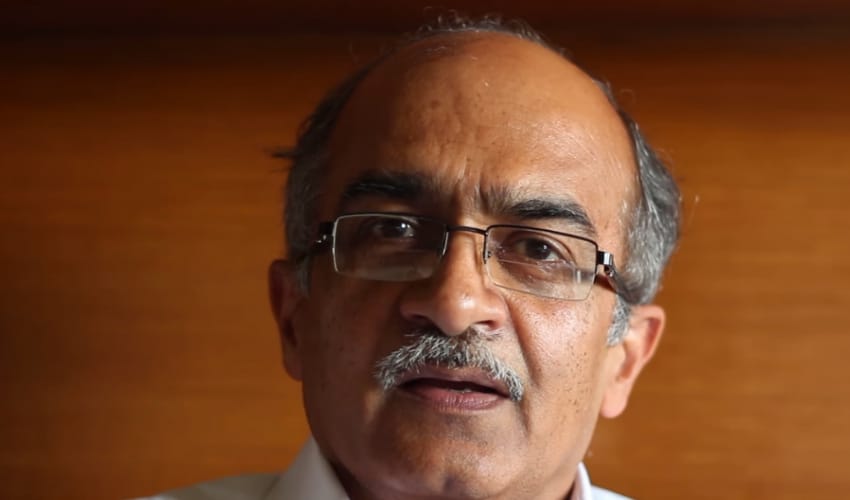

The committee decided to continue with its accommodative stance as long as necessary. RBI Governor Shaktikanta Das made this announcement on Thursday. Repo rate refers to the rate at which commercial banks borrow money by selling their securities to RBI.

The governor said that the MPC had voted unanimously 5:1 to maintain the accommodative stance. The MPC also kept the reverse repo rate unchanged at 3.35 per cent. The Marginal Standing Facility (MSF) rate and bank rate also remained unchanged at 4.25 per cent.

Related Posts

The central bank had last revised its policy repo rate on May 22, 2020. This is the first MPC meeting after the presentation of the Union Budget 2022-23 in Parliament on February 1.

The governor said that India is charting a different course of recovery from the rest of the world. Das added that the real GDP (Gross Domestic Product) growth of India is projected at 7.8 per cent for the next financial year 2022-23 (FY23). GDP is the total market value of all the finished goods and services produced within a country’s borders in a specific period. It provides an economic snapshot of a country.

Das further added that real GDP growth of 9.2 per cent in the current fiscal (FY22) will take the economy above the pre-pandemic level. Das also talked about inflation rates. Das said that the CPI (Consumer Price Index) inflation projection for the current financial year 2021-22 (FY22) is retained at 5.3 per cent. She also said that the retail inflation for the next fiscal (FY23) is projected at 4.5 per cent.