Finance Bill 2024 To Be Presented In Parliament’s Budget Session

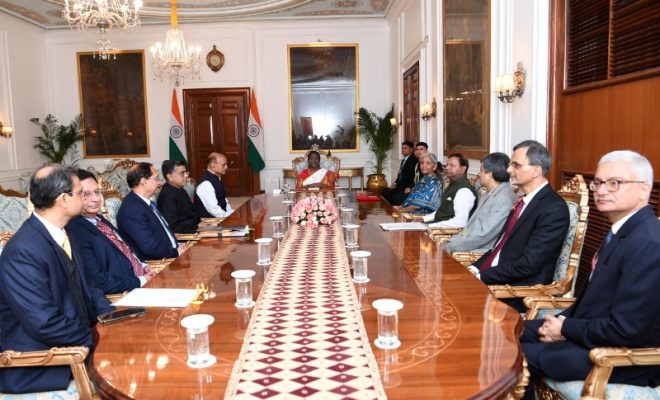

The Indian Parliament’s Budget Session has seen significant activity, especially in the Lok Sabha, where Union Finance Minister Nirmala Sitharaman is set to present the Finance Bill, 2024.

This Finance Bill 2024 bill is crucial as it aims to maintain the current income-tax rates for the financial year 2024-2025. It also includes measures to provide relief to taxpayers and suggests changes in various laws.

A key part of the session’s agenda is the Lok Sabha’s discussion on the Interim Union Budget for 2024-25, which was initially presented on February 1.

Moreover, the Lok Sabha has been busy with other important bills. It reviewed a bill to amend the Jammu and Kashmir Scheduled Castes Order, 1956.

This amendment proposes adding new communities like ‘Valmiki’, ‘Gadda Brahmin’, ‘Koli’, ‘Paddari Tribe’, and ‘Pahari Ethnic Group’ to the list of Scheduled Castes and Scheduled Tribes in Jammu and Kashmir.

Social Justice and Empowerment Minister Virendra Kumar and Tribal Affairs Minister Arjun Munda introduced these bills in the Lok Sabha.

Apart from this, the Lok Sabha passed a significant bill to tackle malpractices in competitive exams like paper leaks. This bill includes strict penalties for unfair practices, including a jail term of up to 10 years and fines up to ₹1 crore.

In the Rajya Sabha, there was a discussion on thanking the President for his address. Two bills related to modifying the list of Scheduled Castes and Scheduled Tribes in Andhra Pradesh and Odisha were passed. Minister Arjun Munda played a key role in introducing these bills.

The government also decided to extend the current Budget session by one day, until February 10. This extension is to present a ‘white paper’ on the Indian economy’s condition before and after 2014.

Also Read: Register Live-In Relationships Or Face 6-Month Jail: Uttarakhand UCC Bill

Additionally, various other bills concerning Jammu and Kashmir are to be moved, including amendments to the Jammu and Kashmir Panchayati Raj Act and the Jammu and Kashmir Municipal Acts.