RBI Steps In To Mitigate Jolt To Economy In Second Corona Wave

Last updated on May 7th, 2021 at 05:00 am

Reserve Bank of India (RBI) is stepping in to help India handled the massive burden put in by the Covid-19 second wave, while the stock market shows healthy balance.

Further, to help state governments to better manage their fiscal situation in terms of their cash flow and market borrowings, the overdraft facility and grace period on it is being increased from 36 to 50 days. The number of consecutive days of OD is being expanded from 14 to 21 days too.

Under the help, it is small businesses and the MSMEs that will be benefiting from the help being offered by the RBI. Under the plan, any financial constraints will be lifted over healthcare infrastructure and services. Also, small borrowers will be pardoned due to a sudden spike in health expenditure.

Related Posts

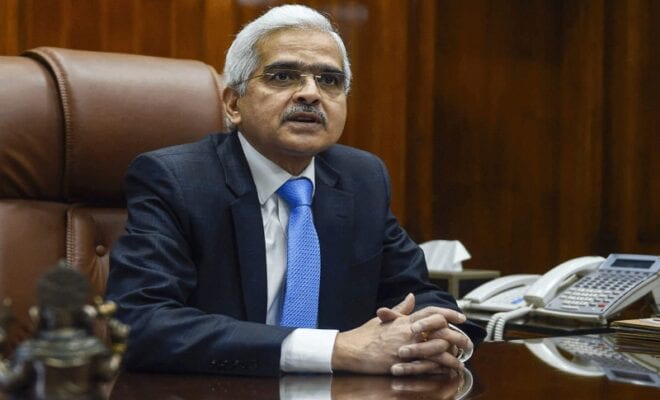

Under an unscheduled announcement by the RBI Governor Shaktikanta Das, Term Liquidity Facility of ₹50,000 crore will be offered for a tenor of up to three years. This will be offered on a repo rate to ease access to credit for providers of emergency health services.

In this new scheme of things, banks will be providing fresh lending support to a wide range of entities, including vaccine manufacturers, importers/suppliers of vaccines and priority medical devices, hospitals/dispensaries, pathology labs, manufacturers and suppliers of oxygen and ventilators, and logistics firms. According to Mr. Das, “These loans will continue to be classified under priority sector till repayment or maturity, whichever is earlier.” This is going to ease off pressure on many smaller business or those who might have taken loans and are now finding it difficult to manage work and medical situations at hand.

Additionally, banks will now be expected to create a COVID loan book under the scheme. This is being treated as a ‘comprehensive targeted policy response’ to the second wave of the second wave of the pandemic.

In response to help smaller business, the RBI will launch a special three-year long-term repo operations (SLTRO) worth ₹10,000 crore at the repo rate for Small Finance Banks. The SFBs would be able to deploy these funds for fresh lending of up to ₹10 lakh per borrower. This facility would be available till October 31.