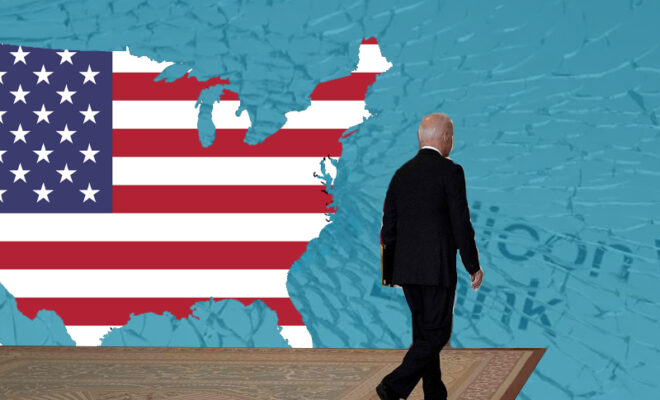

Joe Biden Leaves Press Midway, Avoids Questions On US Banking Crisis

S President Joe Biden said that US banking systems are safe. But he walked away when reporters asked him about the SVB collapse & other American banks’ failure.

President Joe Biden drew criticism on Monday after leaving the news conference midway through giving his final remark about the failure of two significant American banks over the weekend, amid a banking crisis in the country.

Biden responded when a reporter “What do you currently know about what occurred? Also, can you guarantee that there won’t be a knock-on effect on Americans? “.

Without responding, the President began to leave the room. Another reporter interrupted and questioned, “Will more banks fail, President?” but Biden had already left the room and was nowhere to be seen.

Comments have been disabled since the moment the video of him leaving social media got public, which led to a reaction on Twitter.

Also Read:- PM Modi Meets Nokia CEO To Discuss India’s Digital Infrastructure

“You can’t respond to inquiries if you don’t understand what you just said. Although it is astounding that he can read off a teleprompter, it is absurd to believe that he is understanding what he is reading,” a netizen wrote.

Silicon Valley Bank (SVB) failed on Friday as a result of large deposits being withdrawn from the bank in a short period of time, causing US banking officials to promptly close the bank in the midst of the workday.

After the 2008 financial crisis, it is the biggest bank failure in history. Biden committed to take action against individuals in charge of the nation’s banking problem on Monday. His remarks were made following the failure of another American Signature bank.

The SVB failed because it lacked the funds to pay its depositors, quoting “The Conversation”. The sharp rise in interest rates in 2022 and 2023, which led to a sharp decline in the value of the assets, is another significant factor that contributes to the issue.

Also Read- Indian banks urge customers to opt Mobile/Net Banking over cash