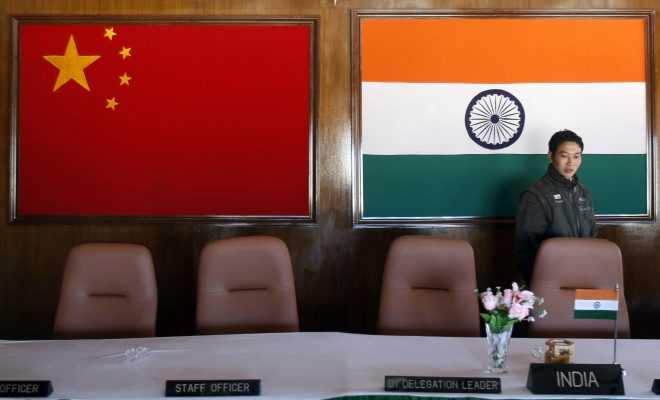

Chinese tech investors take the road towards Indonesia, abandon India

Last updated on February 21st, 2023 at 12:17 pm

Chinese tech investors: After Delhi closes its doors, China’s Venture Capital (VC) investors are shifting their base from India and heading towards Indonesia, the new hot spot in south-east Asia. This has helped south-east Asia’s biggest economy gain a tech investment surge of 55% in just the first half of 2020.

The tech firms that are shifting base from India to Indonesia include Shunwei Capital, which has funds of around $3bn, which is launched by Xiaomi and BAce Capital founders. Shunwei’s co-founder Tuck Lye Koh has communicated of sealing more deals in Indonesia and not investing in new projects in India for now. He also said that for now focus would be to manage the ongoing portfolios in India.

Experts say that this shift to Indonesia is because of Delhi closing its doors for China’s investors and also because Indonesia offers most apt destination with guaranteed serious attention in the region.

China’s investors, both from VC and tech sectors, have had led to bounce in India in past by investing in various start-ups in the country. These include Paytm, Zomato and BYJU’S. But in April, Indian government unleashed strict rules aimed at opportunistic investors in India from China leading to significant funding for Indian start-ups. India blacklisted 43 more Chinese apps in last one week.

Indonesia, the fourth most populated country in world, enjoys the position of being destination to billion-dollar companies and start-ups in the region. This year alone, global tech giants like Facebook, PayPal and Google have invested here.

Well found interest in investing in Indonesia has been noticed by US as well. In fact, Indonesia has left its peers way back including Vietnam and Thailand. The positive attributes offered by Indonesia include valuations and fundraising, which seem to attract the swell interest of China and US. Beau Seil, co-founder of Patamar Capital said, “You’re now seeing some fundraising rounds that are Silicon Valley-esque in size. Valuations have also gone up significantly in Indonesia.”

But Chinese investors believe that very few start-ups in Indonesia are unique in concept an design, and that many are following Indian business models.

Read More: Aashiqui actor admitted after he suffers brain stroke, his right side affected