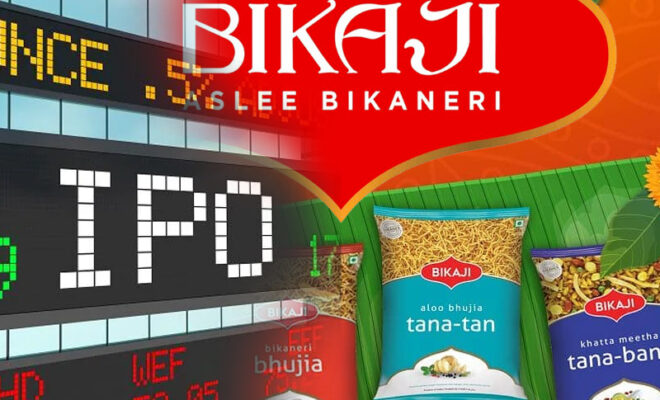

Bikaji Foods International IPO Issues Opens Today

The Indian snacks & sweets company Bikaji Foods International is going to launch its IPO today. The IPO is a direct offer-for-sale (OFS) of nearly 2.94 crore equity shares.

If you’re looking for the complete details for Bikaji Foods International IPO date, price band, share allotment date and listing date, please keep reading this article.

On November 3, subscriptions for the Initial Public Offering (IPO) of Bikaji Foods International will start to be accepted.

Indian snacks plus sweets are offered for sale by the ethnic snack company Bikaji Foods. For its ₹ 881 crore initial public offering, it has set a price range of Rs 285 to 300 per share.

The IPO is a straight offer-for-sale (OFS) by the company’s promoters and current shareholders of 2.94 crore equity shares.

Shiv Ratan Agarwal and Deepak Agarwal, the two promoters, intend to sell up to 25 lakh shares of the firm apiece.

India 2020 Maharaja Ltd, Intensive Softshare Pvt Ltd, IIFL Special Opportunities Funds, and Avendus Future Leaders Fund I are more companies offering their shares.

The company won’t receive any revenues from the issue because the IPO is exclusively an OFS. The IPO is anticipated to raise Rs 881.22 crore at the top of the pricing range.

Investors may place a minimum bid of 50 equity shares and then bid in multiple sets of 50 equity shares.

Allotment Date of Bikaji Foods International IPO

The IPO allocation date for Bikaji Foods International is November 11. On November 15, the winning bidders’ Demat accounts would be credited with Bikaji Foods shares.

Listing Date of Bikaji Foods International IPO

The IPO for Bikaji Foods International will list on the prestigious BSE and NSE marketplaces. The IPO listing date for Bikaji Foods is November 16.

The book-running lead managers for the offer are JM Financial, Axis Capital, IIFL Securities, Intensive Fiscal Services, and Kotak Mahindra Capital Company.