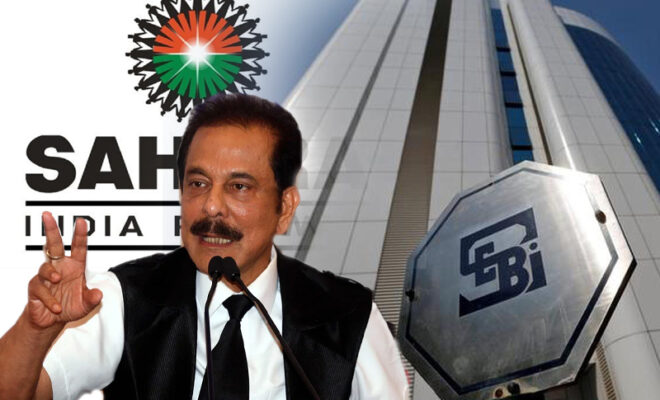

SEBI Recovers ₹6.57 Cr From Sahara, Slaps ₹36 Cr Penalties On Entities

SEBI has recovered ₹6.57 crore in debts from Subrata Roy & his Sahara Group Firms. Sebi has also slapped penalties of ₹36 crore on PNB Finance, CCCL & other entities.

The Sahara Group firms and the group’s founder, Subrata Roy, have paid back debt of 6.57 crore ($882,000) to the Securities and Exchange Board of India (SEBI).

Since approximately ten years ago, SEBI has been attempting to recover more than 25,000 crore ($3.3 billion). The loan was paid off by selling shares of Sahara India Life Insurance, one of the group’s businesses.

The shares were bought and sold at an open auction run by SEBI. To pay off the debt, SEBI has been selling Sahara company shares, and so far it has made back almost 20,000 crore ($2.7 billion).

Since 2010, when the regulator claimed that the Sahara Group was using illegal and unregistered strategies to raise money from investors, the group has been involved in a legal dispute with SEBI.

PNB Finance, Industries CCCL, and a few other people were fined a total of 36 crore ($4.8 million) by the Securities and Exchange Board of India (SEBI) for breaking securities market regulations.

Due to its failure to guarantee compliance with the code of conduct for directors and failing to disclose material information, PNB Finance has been fined 25 crore ($3.3 million).

For delaying the disclosure of its financial results, Industries CCCL was fined 6 crore ($800,000). A few others connected to the companies have also received penalties from SEBI.

The former CEO and MD of PNB Finance both received a fine of 5 lakh ($6,700), as did the former CFO and company secretary of Industries CCCL.

Following an inquiry into the companies’ operations by SEBI, it was determined that they had violated standards for the securities market.