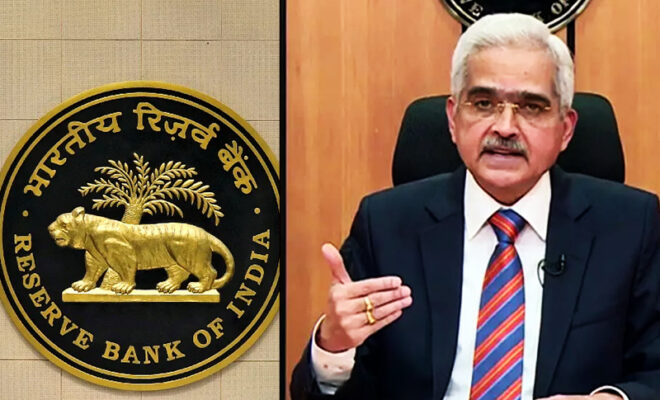

Reserve Bank of India’s Monetary Policy Committee Highlights

The MPC considered the escalating global situation caused by the Ukraine conflict. The resulting supply chain disruptions, according to RBI governor Shaktikanta Das, have resulted in “globalization of inflation.”

The committee voted to lift annual inflation projections in the United States to 6.7 percent from 5.7 percent before. Inflation is expected to continue over the Reserve Bank of India’s maximum tolerance level of 6% this fiscal year.

RBI Governor Shaktikanta Das said in a statement,

“Inflationary pressures have become broad-based and remain largely driven by adverse supply shocks. There are growing signs of a higher pass-through of input costs to selling prices.

The MPC noted that inflation is likely to remain above the upper tolerance band of 6 per cent through the first three quarters of 2022-23.”

Top 5 Key Takeaways From The RBI Monetary Policy Committee

1. Repo Rates Hike By 50 Basis Points

The Reserve Bank of India hikes interest rates by 50 basis points. The MPC of the RBI convened on June 6 and 8 and unanimously decided to raise the policy repo rate by 50 basis points to 4.90 percent, effective immediately.

Keep Reading

2. Raise Of Inflation Projects By 100 Basis Points

The central bank recognized that, based on recent measurements, inflation has become more widespread and has infiltrated significant goods.

The RBI boosted inflation predictions for FY 2023 to 6.7 percent, citing the ‘globalization of inflation,’ particularly as a result of the supply chain issue.

3. RBI reiterates growth outlook.

The MPC of the Reserve Bank of India maintained its 7.2 percent growth forecast for FY 2023.

The central bank considered better domestic circumstances as well as unstable external situations when making its estimates, but opted to leave them unchanged.

4. Improvement In Domestic Situations

According to Shaktikanta Das, global conditions are difficult for India and other big economies. But despite the pandemic and the aftermaths from the Russia-Ukraine conflict, India’s domestic situation is improving at a rapid pace.

5. E-Mandates & UPI Credit Card Integration

Aside from the monetary policy announcements, RBI Governor Shaktikanta Das made a slew of other announcements.

For beginners, the RBI has increased the limit on e-Mandates for recurring payments on credit cards. The RBI has authorized the pairing of UPI with RuPay credit cards, which was previously only possible with debit cards, in order to make digital payments more convenient.