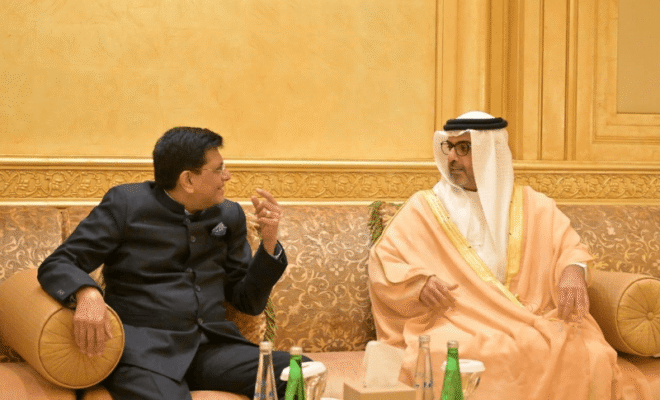

Piyush Goyal to Visit UAE for 13th India-UAE High-Level Task Force on Investments

In order to to co-chair the awaited 13th India-UAE High-Level Task Force on Investments (HLJTFI) Honorable Union Minister of Commerce and Industry, Shri Piyush Goyal is going to visit the United Arab Emirates (UAE) on 18 to 19 September 2025 along with His Highness Sheikh Hamed bin Zayed Al Nahyan and the Abu Dhabi Investment Authority’s Managing Director. This important development also reflects the Latest news in India related to international trade and investments.

If you want more insights into this evolving India-UAE economic partnership, read our article India-UAE CEPA: A Milestone in Bilateral Trade.

Strengthening Strategic Economic Ties

This meeting is aiming to review one of the important implementations of the Comprehensive Economic Partnership Agreement (CEPA), which has significantly raised bilateral trade, which is now reaching $83.7 billion. This discussion will be focusing on the Double Taxation Treaty while planning to enhance cooperation between the central banks of both the nations. These all significant efforts are part of consolidating the UAE’s role where India’s top trading partner in the Middle East and North Africa (MENA) region.

Unlocking New Investment Frontiers

In this meeting the task force will also be exploring joint opportunities in maritime along with space, and even high-potential non-oil sectors. Bilateral meetings with leadership from ADIA, Abu Dhabi Department of Economic Development (ADDED), and along with International Holding Company (IHC) which will be focusing on advancing large-scale projects. These key areas of interest include technology, energy, defense, and including food security which aim to channel investments into all these critical sectors.

Business Leadership Engagement

Minister Goyal will be co-chairing the UAE-India Business Council Roundtable along with the UAE’s Minister of Foreign Trade. This dialogue will involve CEOs from leading Indian and Emirati companies, fostering discussions so that it can boost private sector flows. Platforms created to address all the investor concerns and accelerate Foreign Direct Investment (FDI) growth, by enhancing bilateral economic relations.